Back IBAN Afrikaans رقم الحساب المصرفي الدولي Arabic İBAN Azerbaijani Міжнародны нумар банкаўскага рахунку Byelorussian Міжнародны нумар банкаўскага рахунку BE-X-OLD Международен номер на банкова сметка Bulgarian Número de compte bancari internacional Catalan International Bank Account Number Czech Internationale Bankkontonummer German Διεθνής τραπεζικός λογαριασμός Greek

The International Bank Account Number (IBAN) is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution.[1] It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. By July 2023, 86 countries were using the IBAN numbering system.[2]

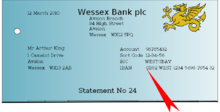

The IBAN consists of up to 34 alphanumeric characters comprising a country code; two check digits; and a number that includes the domestic bank account number, branch identifier, and potential routing information. The check digits enable a check of the bank account number to confirm its integrity before submitting a transaction.

- ^ "What is IBAN, BBAN, SWIFT, BIC, ACH, SEPA, SCT and SDD?". www.iban.com. Retrieved 2023-02-01.

- ^ Cite error: The named reference

IBANRegistrywas invoked but never defined (see the help page).